Hometown Heroes Down Payment Assistance Program | HOMETOWN HEROS DOWN PAYMENT ASSISTANCE PROGRAM

Hometown Heroes Down Payment Assistance Program | HOMETOWN HEROS DOWN PAYMENT ASSISTANCE PROGRAM

Florida Hometown Heroes Housing Programs

This program is designed to assist front-line employees to achieve their homeownership dreams. Any employee with sufficient income and an acceptable credit score can apply for these programs. The mortgage and income limit have recently increased to match the increase in home prices. Alongside the down payment assistance and closing costs, the program offers many other benefits.

Additional Benefits of Hometown Heroes Housing Programs

- Lower Interest Rate – This program allows for interest rates that are lower than the market rates. Lower rates apply to all FHA, VA, RD, Fannie Mae, and Freddie Mac loans.

- Lower Loan Costs – Along with down payment and closing costs assistance, all borrowers can enjoy reduced upfront fees, no discount points, and no origination points.

- Higher Assistance Amount – The maximum amount of the down payment assistance has increased to a maximum of 5% of the first mortgage (or up to $25,000)

- Loan Conditions – The assistance program is intended for first-time home buyers. Veterans are exempt from the requirement to be first-time Homebuyers. The amount of the assistance is considered a second mortgage. This is a zero-interest, zero amortization 30 years deferred mortgage. The loan is not payable unless one of the following conditions is met:

▪ Sale of the property

▪ Refinancing of the Property

▪ Transfer of the deed

▪ Property not occupied as the primary residence by the borrower

The second mortgage becomes due if any of the above events take place.

Income and Loan Limits for Hometown Heroes Housing Program

The recent increase has been applied to the income limits and the mortgage amount to reflect the noticeable increase in home prices. These limits vary by each county. For example, the current annual income limit in St Lucie County is $120,000. Meanwhile, the maximum amount for an FHA mortgage is established at $431,250, while Conventional and VA loans are capped at 726,200. Please contact us for more information regarding the limits for other Florida counties.

These are new and improved features. Manufactured Homes are eligible for borrowers with 660 Credit Scores. FHA loans can be manually underwritten with a Credit Score of 660. Newly constructed Homes are eligible for this program. FHA and FNMA Conventional Loans allow non-occupant Co-signors which can make for easier qualifying. FNMA and FHLMC reduced MI with Homebuyers with less than 80% AMI. DTI ratios up to 50% with AUS Approve/Eligible

Qualifying Occupations for Down Payment Assistance Programs

There is a comprehensive list of qualifying occupations for obtaining down payment and closing costs assistance. The following are some of the eligible occupations:

• Healthcare Employees – Covers a wide variety of healthcare-related workers including but not limited to the following:

▪ Nurses and Certified Nursing Assistants, CNA – Nurses including RN, LPN, APRN, Clinical Nurse Specialist, Certified Registered Nurse Anesthetist, Certified Nurse Midwife, Nursing Home Administrators

▪ Medical Doctors and Assistants– The following is an example of employees covered under the healthcare category:

◦ Physicians – and Physician Assistants, Certified Medical Assistants

◦ Acupuncturists – and Chiropractic Physicians, Certified Chiropractic Assistants,

◦ Anesthesiologists – and Anesthesiologist’s Assistants,

◦ Psychiatrists

◦ Psychologists – and School Psychologists

◦

◦ Physical Therapists – and Physical Therapist Assistants

◦

◦ Pharmacists – Pharmacy Technicians

◦ Dentists – and Dental Assistants, Dental Hygienists

◦ Speech-Language Pathologists – or Audiologists and their certified assistants

◦ Occupational Therapists – and their certified assistants

◦ Certified or Registered Respiratory Therapists – and Respiratory Care Practitioners

◦ Licensed or Registered Dieticians or Nutritionists – and Licensed Nutrition Counselors, and Dietetic Technicians

◦ Prosthetist, Orthotist – Prosthetist Orthotist, Pedorthist, Prosthetist, Orthotic Fitter, Orthotic Fitter Assistant

◦ Genetic Counselor

◦ Home Health Specialist – Working for a licensed home health agency

◦ Clinical Laboratory Personnel – Laboratory Director, Supervisor, Technologist, Blood-Gas Analyst, Laboratory Testing Technician

◦ ●Hearing Aid – Hearing Aid Specialist – Hearing Aid Specialist Trainee

◦ Athletic Trainer – Licensed by the Florida Board of Athletic Training

◦ Electrologist

◦ Massage Therapist

◦ Opticians and Certified Optometrists

◦ Phlebotomist – Full-time employment and successful completion of an accredited phlebotomy course are required

◦ Radiology – Licensed Medical Physicist (Radiologic), Certified Basic X-Ray Machine Operator, Certified Radiologic Technologist, Certified Radiology Assistant, Certified General Radiographer, Specialty Technologist (Radiologic)

Port Saint Lucie Ranked as #3 in Best Cities to Retire in Florida

Port Saint Lucie Ranked as #3 in Best Cities to Retire in Florida

According to the US News report dated December 3rd, 2019, Port Saint Lucie is ranked as the 3rd best place to retire in Florida. The following list of the recent awards and accomplishments of Port St Lucie may help to better understand the reason for this popularity:

Port St Lucie activities

• Port Saint Lucie as a Safe City – According to Realtor.com, the city of Port Saint Lucie is ranked #3 as the safest city in the US. https://www.realtor.com/news/trends/10-safest-affordable-us-cities-where-youd-actually-like-to-live/

• Dynamic City and Urban Center – Point2Homes have ranked Port Stain Lucie as #2 among the small cities in the US as the most dynamic. Also, the same source has given Port Saint Lucie the #15 ranking in comparison to all cities in the nation.

https://www.point2homes.com/news/us-real-estate-news/americas-dynamic-urban-centers-150-u-s-cities-ranked.html

• Best City to Retire – Port Saint Lucie has been ranked as #5 for the Best Cities to Retire by US News.

https://www.usnews.com/info/blogs/press-room/articles/2019-10-08/us-news-unveils-the-2020-best-places-to-retire

Retiring in Florida has been the cliche for many decades with over 900 people making it a reality every single day. There has never been any doubt about the Sunshine State’s popularity with retirees and non-retirees. However, the dilemma for the future residents has been deciding on what part of Florida to move to. Coastal Florida has been a top choice for many years until the baby boomers reached the retirement age and start changing the norm, as they have been doing it all their lives.

The rise of the Villages, The Tradition, and Margaritaville communities that are located away from the coastline is a perfect example of the change. This has also had an immense impact on the growth of some cities offering close proximity to the coastlines without the housing and insurance costs associated with living by the ocean.

Port Saint Lucie, FL has been quietly leading the rest of the State as a near-coast city with the highest rate of growth during the last two decades. According to the census bureau, the population of Saint Lucie county was 89,155 in 2000 and 193.400. This is while the same source reports Port Saint Lucie population for 2017 at 189,344 and St Lucie County at 313,506 a whopping 100.12% increase in 17 years.

There are many reasons for such an increase in population for a city known for keeping a low profile to become the 7th largest city in Florida in a short time. The close proximity to the wonderful beaches of the Atlantic Ocean, low housing expenses, and safety are a few reasons to mention for the increase in the migration to Port St Lucie and the Treasure Coast area.

Beaches in St Lucie County

Best Homes in Best City at Best Prices in Poet St Lucie

I have been living in South Florida for over 40 years and it took me 33 years to find the city which offers the best lifestyle and home prices at the same time! Port Saint Lucie, FL has been my home since 2102 and the only regret I have is why I didn’t make the move earlier. Being involved in the real estate industry for 19 years has afforded me the ability to appreciate and recognize good real estate opportunities with future appreciation, and Port Saint Lucie offers both. I have worked in the real estate markets in Miami/Dade, Broward, and Palm Beach Counties and appreciate the unparalleled values we offer in Port Saint Lucie and the Treasure Coast area. The price difference for some areas could be higher than 50% to 75% when compared to home values in Port St Lucie. The great housing values combined with an amazing lifestyle, safety, and a short driving distance to the famous beaches of Hutchinson Island and Jensen beach have resulted in the popularity of Port Saint Lucie.

Moving Boxes & Supplies

Port St Lucie Real Estate Market Report 2020

Port St Lucie Real Estate Market Report 2020

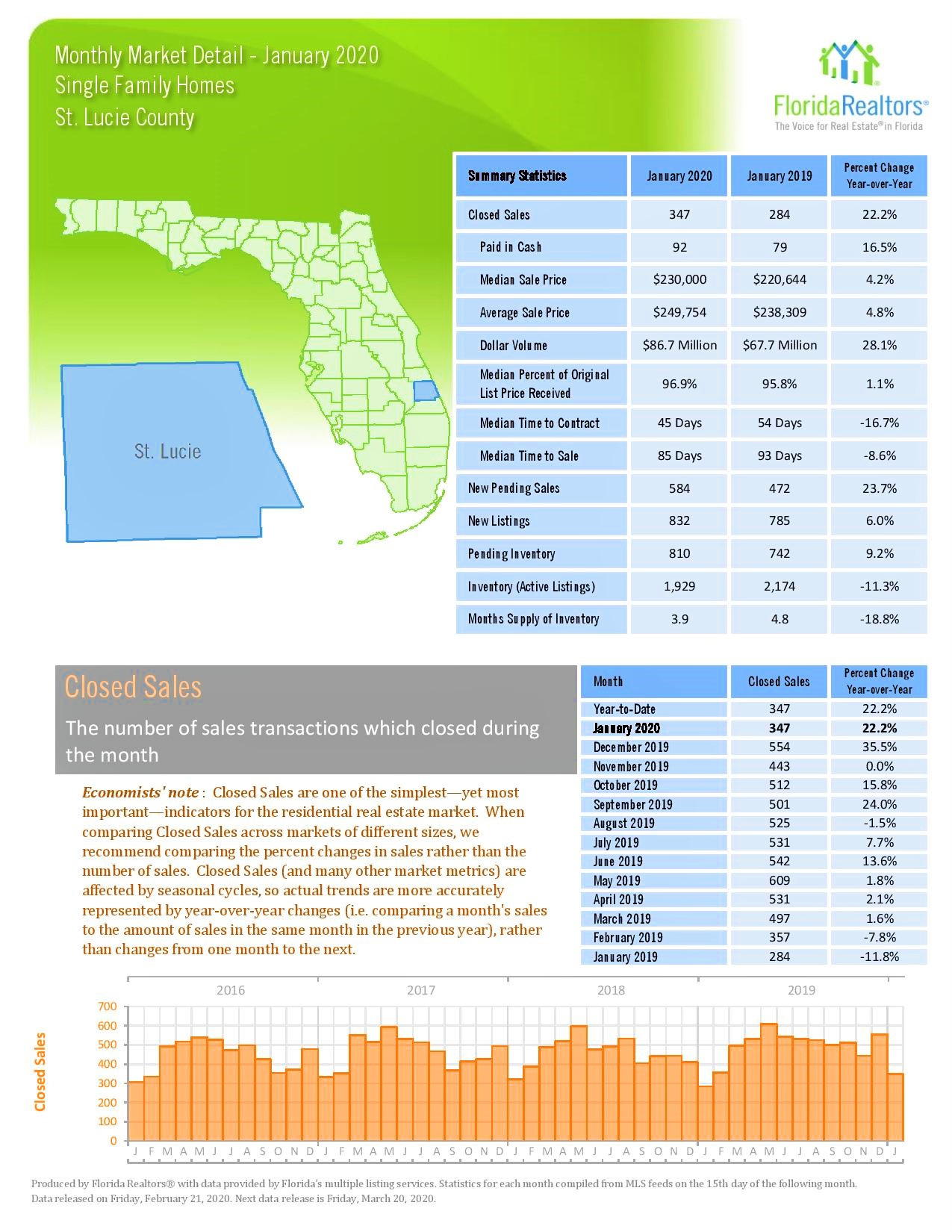

St Lucie County Real Estate Report January 2020

The report contains the local real estate activities for the homes sold by Realtors® and homes sold by owners are not a part of this report. The Florida Association of Florida, FAR, shows the continuation of the established trend of rising prices. Although there is an increase of 4.2% on average home prices the area still offers some of the best bargains when compared to other nearby counties. This has brought an influx of homebuyers from southern counties to Port St Lucie and Tradition area.

The report contains the local real estate activities for the homes sold by Realtors® and homes sold by owners are not a part of this report. The Florida Association of Florida, FAR, shows the continuation of the established trend of rising prices. Although there is an increase of 4.2% on average home prices the area still offers some of the best bargains when compared to other nearby counties. This has brought an influx of homebuyers from southern counties to Port St Lucie and Tradition area.

St Lucie Real Estate Market January 2020

The most notable changes for single-family homes in the St Lucie County real estate are:

- Median Price- Rose to $230,000 in January of 2020 from $220,644 in the same period in 2019, a 4.2% increase.

- Average Days on Market- Drop to only 45 days in comparison to 54 days in January of the last year. This is a clear indication of low inventory and high demand, which in turn fuels the rising prices.

- Inventory- The total inventory for single-family homes for sale in St Lucie Country is only 3.9 months in comparison to 4.8 months in January 2019. Considering the shortage of inventory of homes for sale in 2020, a drop of 18.8% representing a bustling sellers’ market. This is in addition to the construction of the new homes which home builders have been adding to the inventory. Ultimately, with the continuous shortage of inventory, the higher prices are inevitable. The problem for surrounding counties is more severe as some like Palm Beach County has reached the boiling point of maxed out prices much earlier in 2014.

Overall the Port St Lucie real estate report for January 2020 indicates a stronger seller’s market which combined with anxious buyers has resulted in some listings ending up in the multiple offer situation. This is a reminder of how the market went crazy in the last decade’s real estate boom. Multiple offers, price war, anxious buyers trying to buy before prices increase even higher while sellers holding back in the hope of cashing out even more in tomorrow’s market. With Port St Lucie real estate prices being lower than the neighboring counties the market is destined to stay active attracting buyers from other areas who can no longer afford their local real estate.

How to Sell Your House

How to Sell Your House

How to Sell Your Home

Selling Port St Lucie Homes

When it comes to selling your home there are a multitude of issues to be mindful of in order to sell the property at the highest price and shortest time possible. Without a good planning the homeowners risk either leaving money on the table or wait for a long time to sell.

For Sale by Owner or Sale by Realtors®

Making the decision of selling by owner or hiring a Realtor® is perhaps the most important step in sale of any property. While homeowners may think that it’s all about the commission the issue is much broader than the money alone. The Realtors® are trained and experienced in many aspects of the sale of properties that homeowners may not be familiar with. The following is a brief list of what a Realtor® bring to the table and the homeowners could risk to lose many or face legal consequences if they’re not an expert in any of these fields:

-

Pricing a Home for Sale – The correct pricing of a home for sale is the first step in sale of any property. The homeowners should be aware of false prices floating around on different real estate related website. The algorithm of most such websites are not able to differentiate between a related and unrelated compatible sales. For example, the prices of the 3 homes sold in the same area does not necessarily portrays the average price to use for the sale of your home. This is because one of the homes could have a swimming pool while the other offers 2 extra bedrooms and the third home was built more recent than the other two. As a matter of fact, there has been lawsuits by homeowners against one of the most prominent real estate websites for miscalculating the home prices. The Realtors®, on the other hand, have access to many compatible home sales records and the knowledge of how to adjust the prices when the comps are not exact the same. According to the National Association of Realtors® report in 2016, the average home prices sold by For Sale By Owners was $185,000 while the average for homes sold with Realtors® assistance was $245,000 q whopping $60,000 difference. This is a little over 30% deficit which makes the average customary commission of 6% charged by real estate companies a true bargain. This is the main reason why some homeowners have claimed they have lost money due to the incorrect lower price estimate by the real estate websites.

-

Negotiating the Price – Like any other transactions, everything is negotiable when selling a home and the negotiation is not limited to the price of the property. There are items such as title insurance or repairs in the outcome of the inspection that can be negotiated to pay by either party to transaction. How to negotiate the price and when to stand firm or counter offer are crucial negotiation skills which may lack in the For Sale by Owner sales.

-

Inspection Problems – In most transaction the buyers will hire an inspection companies to make sure there are no hidden defects in the property. Some inspectors have the tendency of over-exaggerating the simple flaws in the house which may create panic by the home buyers. In one instance we had an inspection report indicating a cost of $760 for replacement of a sliding glass door which only needed couple of rollers at cost of less than $20. An experienced Realtor® is well versed in recognizing the bogus defects in inspector report from the serious ones. However, it is the Realtors® duty to skillfully negotiate the legitimate shortcomings in the inspection report in order to preserve the integrity of the transaction while minimizing the costs to the home sellers.

-

Appraisal Issues – Sometimes everything going smooth in a transaction until the appraised value falls short of the agreed upon contract price. The Appraisal issues generally arise from the appraised value falling below the contract price. There are few reasons for this:

-

Wrong List Price – Sometimes, the problem stem from the Realtors® knowingly price the listing much higher than the fair market value in order to please the sellers to list with them. Other times the incorrect pricing is done unknowingly by inexperienced or out-of-area Realtors®. Once the appraisal report is published it will be very difficult to convince any buyer to pay more than the appraised value and most importantly the lender will not grant a mortgage for more than what the appraiser has priced the property. Tin case of the cash deals, the more sophisticated buyers would order appraisal. In all real estate transactions, the sellers and their agents should discuss and have a plan B to face any appraisal shortfall.

-

Appraisal Miscalculations – At times the appraisal issues are due to the miscalculations by the appraiser. This could be due to many different circumstances:

-

Out of the Area Appraiser – Although appraisers are only depend on the latest compatible home sales in the area to correctly estimate the value of any property but the lack of knowledge the local real estate market and trends could create a problem. For example, during the crazy real estate market in the Broward County during the mid-2000s at some point the property values were rising on staggering rate of 10% a month. This created a problem when an out of area appraiser used the compatible sale from 3 months earlier without considering the market trend.

-

Lack of Compatible Sale – This is more true when it comes to sale of a property in a unique subdivision or gated community where there are not enough sales for the appraiser to locate compatible properties necessary to correctly estimate the value. Appraisers generally consider the sales of similar properties taking place in past 3 months, within the same community or one-mile radius as acceptable comps.

-

-

-

Communication with All Parties – In addition to the buyers and sellers there are many other people and companies involved in each real estate transaction. An experienced Realtor® shall always be in constant communication with all parties and report any and all issues to the sellers. The bank or mortgage companies, title company, appraisal, and inspection companies are few entities who are routinely involved in the outcome of all real estate transactions.

-

Closing on the Property – The Closing Disclosure will be send to both buyers and sellers by title company 48 hours prior to closing. Examine the Closing Disclosure thoroughly and don’t hesitate to ask questions and challenge any fluff charges. Please note, some of the expenses are non-negotiable, fixed line-items such as Doc-Stamp or pro-rated property taxes that are collected on behalf of the County or State of Florida.

Florida Property Taxes and Homestead Exemption

Florida Property Taxes and Homestead Exemption

Calculating Property Taxes

Learn How to Estimate Property Taxes

Although the calculation of the property taxes is a fairly simple math there are a significant misunderstanding and confusion among homeowners and even real estate professionals. The purpose of this article is to streamline the process and take the myths out of understanding the property taxes.

Previous Owners’ Taxes

This is the first step where most of the confusions begins. Rule number one is not to even look at how much property taxes the previous owners are paying unless they purchased the house in the same tax year and have not applied any exemptions to their property taxes. The reason for this is the recalculation and adjustment of the Assessed Value upon purchase of a home by the county.

Assessed Value and Market Value

Assessed Value is a dollar value used solely for calculating the property taxes and set normally by the property appraiser office in your jurisdiction. The assessed value is not the same as the appraised value, market value or the purchase price. Based on the jurisdiction, the Assessed Value is around 90% or 80% of the Market Value. For Example, if the Market Value of a property is $100,000 the property taxes are calculated based on 80% of Market Value or $80,000. Most websites for Property Appraiser’s Offices offer an online Tax Estimator tool, which estimates the new taxes for the property you are purchasing. Check with your local Appraiser Office’s website in your county for the availability of this tool.

Millage Rate

Millage is similar to a tax rate and set by Board of Commissioners, School Boards and other agencies who have the authority to levy taxes. Each Mill is equal to $1 per $1,000 of the Assessed Value. To calculate the property taxes, the Assessed Value is simply multiplied by the Assessed Value. In the example above, if the Millage is 2.

Homestead Exemption

The Homestead Exemption aoolies to all primary residence in the State of Florida. While some states offer this exemption only to older citizens the Homestead Exemption applies to everyone in Florida. It is very important to know other benefits of a property which is qualified as a homestead. The Homestead Properties are immune from the forced sales imposed by some creditors but not all. All judgment liens resulting from litigation for negligence of the homeowner or for breach of contract are protected by homestead laws. The liens on non-homestead properties, however, are fully enforceable in the State of Florida.

The liens which are voluntarily put in place by homeowners are not protected by Homestead laws. These liens include the mortgage, taxes, and liens due to non-payment of debt for repairs or improvement of the property are some example of the liens not exempt from creditor from claims against the property.

In addition to Florida residency, there are other requirements such as the ownership and occupancy and the location and sise of a property to qualify as a homestead. There is no limit on the value of the property to qualify for homestead. This has made Florida a haven for people with large assets and debts arising from lawsuits, They can easily transfer an unlimited amount of money to purchase a homestead property and will be automatically shielded from in-state or out-of-state judgments. Many famous people like OJ Simpson and Burt Reynolds have used Florida Homestead Laws to their benefit by purchasing high-priced homestead homes. The amount of Homestead Exemption is up to $50,000 for married couple and $25,000 for individual qualified homeowners.

How to Qualify for a Mortgage

How to Qualify for a Mortgage

How to Qualify for a Mortgage

Qualifying for and obtaining a mortgage is the first hurdle the home buyers may face. The process is handled by mortgage professionals who will issue a pre-approval letter indicating the amount of the mortgage the homebuyers could qualify for. This is an important step when it comes to sending an offer on any property since most home sellers and their agents will not entertain offers without a pre-approval letter.

Buyers should familiarize themselves in advance with terms like Amortization, Fixed and Adjustable Rate Mortgage (ARM) and compare the rates along with monthly payments for 30 years, 20 years, and 15-year mortgages and choose the plan that will suit their long term goals. In the long run, this could save them tens of thousands of dollars during the life of the loan and remember; there’s no substitute for knowledge and preparation.

Homebuyers should be educated about the loan options including the rates and terms of the mortgage, which are always detrimental in obtaining the best loan. The knowledge of understanding and checking the financing details such as the downpayment options or PMI (Private Mortgage Insurance) with different mortgage lenders are some of the most important steps when applying for a mortgage and getting the best value afforded to them.

Documents Necessary for Obtaining a Mortgage

Having all the documents necessary for obtaining a mortgage ready in advance is a great help in expediting the mortgage process. The following list covers the majority of the documents the home buyers will need although different lenders may ask for additional supporting paperwork:

-

W2 Forms for Past 2 Years

-

Pay-Stubs (or other proofs if not receiving pay-stubs)

-

Tax Returns for Past 2 Years

-

List of Debts

-

List of All Assets

-

Profit and Loss Statements for Self-Employed

-

Proof of Timely Payments for Renters

-

Bankruptcy Documents (if applicable)

-

Proof of Any Additional Income (such as divorce decree)

-

Gift Letter (if applicable)

It is important to remember to update these documents if any changes to employment, income or debt occur. Lenders do not like surprises. We have had instances when the lender approved a loan and a few days prior to the closing pulled another credit report which resulted in the cancellation of the mortgage because the buyer signed up for a new leased car. This cancellation of the loan was simply due to the change in Debt/Income Ratio or as otherwise called the Obligations/Income Ratio.

Calculating Debt-to-Income Ratio

Home buyers should be aware of their Debt-to-Income Ratio before applying for a loan. This ratio along with the credit score are the two most important factors in the approval of a mortgage as well as obtaining the best interest rate. Sometimes, it is well worth the effort to pay-off or pay-down some of the debts in order to qualify for a mortgage. The ratio is consisting of only two factors; Income and Debt and the homebuyers could either try to decrease their debt obligation or increase their income, which the later may be more difficult than lowering the debt.

To calculate the Debt-to-Income Ratio simply divide all debts by your income. For example, if the total monthly debts are $2,000 and your monthly income is $5,000, the Ratio is 40%. Although the Ratio may vary by each lender the rule of thumbs for an acceptable ratio should be less than 36%. That said, the government-backed mortgages such as FHA have their own DTI ratios. The 2019 Debt-to-Income Ratios for FHA are 43% for total debt obligations and 31% for total housing payments.

Kings Isle Real Estate Sales Report

Kings Isle Real Estate Sales Report

Market Report for Kings Isle Port St Lucie, FL 34986

Kings Isle Real Estate

The market report for the calendar year of 2019 consists of 64 closed sale transactions on record for Kings Isle Port St Lucie, FL 34986. The average is 5.3 sales a month for sold properties in the Kings Isle 55+ community while there were. This is not, by all means, any indication of the market slowing down, on the contrary, the Port St Lucie real estate market is still a sellers’ market in comparison to some other counties. I would contribute to the lower volume of the sales to the soaring popularity of this wonderful community preventing the homeowners to sell their Kings Isle homes since they will not find a better value elsewhere.

The lowest price sale in Kings Isle belongs to a 1,217 Sq Ft 2/2 villa which was sold for $125,000 while a 3/2 single-family home with 2,102 Sq Ft under air sold for $254,400. The market has steadily increased during the past few years while the Days On The Market (DOM) have been declining. 43 our of 64 closed sales for homes in Kings Isle were on the market for less than 40 days while 14 listings closed in less than 10 days

Kings Isle homes in Port St Lucie are still a bargain for the active adult homebuyers. The incredible amenities, secure community with 24 hours manned security gate, lush landscaping, and close proximity to shopping and medical facilities have made Kings Isle a favorite with many residents. The home prices in Kings Isle are much lower than similar homes in neighboring counties, bringing an influx of more home buyers to the market. The low inventory of affordable homes in Port St Lucie has also made Kings Isle homes very popular with homebuyers. For northerners, retirees, and baby boomers the lifestyle in Kings Isle is like being on a tropical vacation all year long.

Our office has been successfully representing both buyers and sellers in many successful transactions in Kings Isle Port St Lucie, FL. The low inventory has created an additional pool of qualified buyers ready to purchase homes in Kings Isle Port St Lucie. If you wish to sell your home, this is a perfect time. The low-interest rates have been instrumental in qualifying more buyers who will not be able to afford these prices when the rates go up. Please contact us for a confidential evaluation of your home by one of our expert real estate professionals or get the most recent Kings Isle properties for sale list:

Phone: (772) 323-6730

Email: info@portstlucie.city

Buyers get automated properties for sale and compare other 55+ communities in the Port St Lucie area including Vitalia at Tradition, the Cascades at St Lucie West, and Lake Park at Tradition