Port Saint Lucie Ranked as #3 in Best Cities to Retire in Florida

Port Saint Lucie Ranked as #3 in Best Cities to Retire in Florida

According to the US News report dated December 3rd, 2019, Port Saint Lucie is ranked as the 3rd best place to retire in Florida. The following list of the recent awards and accomplishments of Port St Lucie may help to better understand the reason for this popularity:

Port St Lucie activities

• Port Saint Lucie as a Safe City – According to Realtor.com, the city of Port Saint Lucie is ranked #3 as the safest city in the US. https://www.realtor.com/news/trends/10-safest-affordable-us-cities-where-youd-actually-like-to-live/

• Dynamic City and Urban Center – Point2Homes have ranked Port Stain Lucie as #2 among the small cities in the US as the most dynamic. Also, the same source has given Port Saint Lucie the #15 ranking in comparison to all cities in the nation.

https://www.point2homes.com/news/us-real-estate-news/americas-dynamic-urban-centers-150-u-s-cities-ranked.html

• Best City to Retire – Port Saint Lucie has been ranked as #5 for the Best Cities to Retire by US News.

https://www.usnews.com/info/blogs/press-room/articles/2019-10-08/us-news-unveils-the-2020-best-places-to-retire

Retiring in Florida has been the cliche for many decades with over 900 people making it a reality every single day. There has never been any doubt about the Sunshine State’s popularity with retirees and non-retirees. However, the dilemma for the future residents has been deciding on what part of Florida to move to. Coastal Florida has been a top choice for many years until the baby boomers reached the retirement age and start changing the norm, as they have been doing it all their lives.

The rise of the Villages, The Tradition, and Margaritaville communities that are located away from the coastline is a perfect example of the change. This has also had an immense impact on the growth of some cities offering close proximity to the coastlines without the housing and insurance costs associated with living by the ocean.

Port Saint Lucie, FL has been quietly leading the rest of the State as a near-coast city with the highest rate of growth during the last two decades. According to the census bureau, the population of Saint Lucie county was 89,155 in 2000 and 193.400. This is while the same source reports Port Saint Lucie population for 2017 at 189,344 and St Lucie County at 313,506 a whopping 100.12% increase in 17 years.

There are many reasons for such an increase in population for a city known for keeping a low profile to become the 7th largest city in Florida in a short time. The close proximity to the wonderful beaches of the Atlantic Ocean, low housing expenses, and safety are a few reasons to mention for the increase in the migration to Port St Lucie and the Treasure Coast area.

Beaches in St Lucie County

Best Homes in Best City at Best Prices in Poet St Lucie

I have been living in South Florida for over 40 years and it took me 33 years to find the city which offers the best lifestyle and home prices at the same time! Port Saint Lucie, FL has been my home since 2102 and the only regret I have is why I didn’t make the move earlier. Being involved in the real estate industry for 19 years has afforded me the ability to appreciate and recognize good real estate opportunities with future appreciation, and Port Saint Lucie offers both. I have worked in the real estate markets in Miami/Dade, Broward, and Palm Beach Counties and appreciate the unparalleled values we offer in Port Saint Lucie and the Treasure Coast area. The price difference for some areas could be higher than 50% to 75% when compared to home values in Port St Lucie. The great housing values combined with an amazing lifestyle, safety, and a short driving distance to the famous beaches of Hutchinson Island and Jensen beach have resulted in the popularity of Port Saint Lucie.

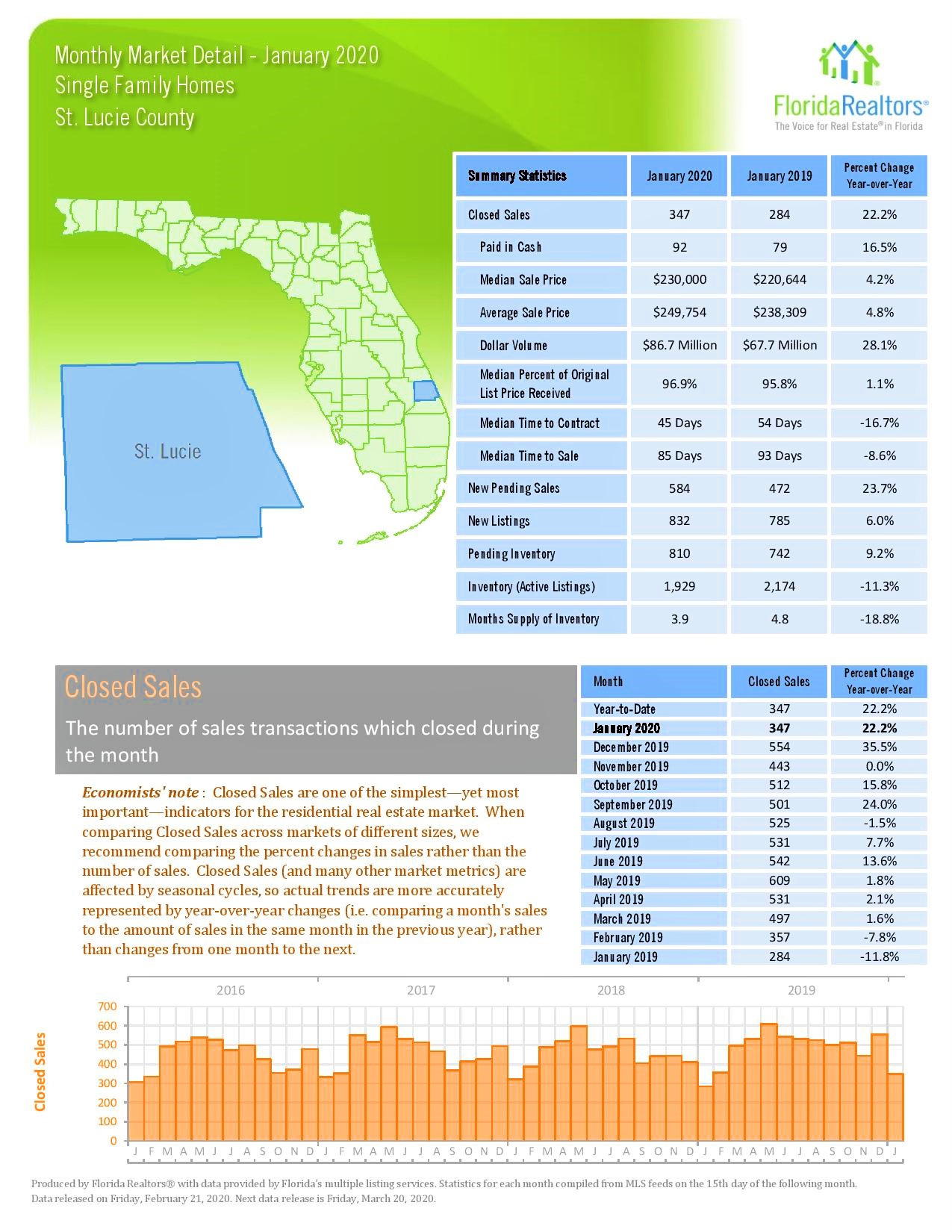

The report contains the local real estate activities for the homes sold by Realtors® and homes sold by owners are not a part of this report. The Florida Association of Florida, FAR, shows the continuation of the established trend of rising prices. Although there is an increase of 4.2% on average home prices the area still offers some of the best bargains when compared to other nearby counties. This has brought an influx of homebuyers from southern counties to Port St Lucie and Tradition area.

The report contains the local real estate activities for the homes sold by Realtors® and homes sold by owners are not a part of this report. The Florida Association of Florida, FAR, shows the continuation of the established trend of rising prices. Although there is an increase of 4.2% on average home prices the area still offers some of the best bargains when compared to other nearby counties. This has brought an influx of homebuyers from southern counties to Port St Lucie and Tradition area.