St Lucie County Home Buyers

St Lucie County Home Sales Report

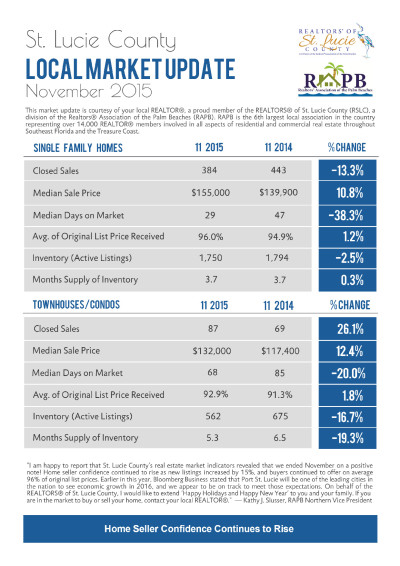

The new report for St Lucie County Home Sales Report for November 2015 is released and there are few changes when compared to the same period last year. The first important statistic belongs to the median price homes for sale in St Lucie County. With home prices on the rise, there is no major surprise in the median prices jumping from $139,900 to $155,000. Actually, this is lower than some of the previous months when the median prices were above $160,000. Although the 38.3% increase for November is very significant but the overall prices of homes for sale in the county and especially in Port St Lucie are still below the average prices in the neighboring Martin County, Indian River County, and Palm Beach County. The lower prices in great communities have prompted many home buyers of these Counties to join the home buyers in Port St Lucie to purchase homes before the prices go up even further.

The new report for St Lucie County Home Sales Report for November 2015 is released and there are few changes when compared to the same period last year. The first important statistic belongs to the median price homes for sale in St Lucie County. With home prices on the rise, there is no major surprise in the median prices jumping from $139,900 to $155,000. Actually, this is lower than some of the previous months when the median prices were above $160,000. Although the 38.3% increase for November is very significant but the overall prices of homes for sale in the county and especially in Port St Lucie are still below the average prices in the neighboring Martin County, Indian River County, and Palm Beach County. The lower prices in great communities have prompted many home buyers of these Counties to join the home buyers in Port St Lucie to purchase homes before the prices go up even further.

The second number in the report is the Number of Days on the Market statistics. This number along with the active inventory are the main indicators of the type of market we are currently experiencing. The low numbers representing the Sellers Market while the high numbers is an indication of the Buyers Market. For a balanced market, we expect the Days on the Market to be between 60 to 90 days and an inventory of 6 months. The Number of Days on the Market for the November report is 29 days versus the 47 days in the previous year. The inventory of the available homes for sale in St Lucie County, on the other hand, has stayed the same for 3.7 months. Both of these numbers are well below the numbers in what is considered as a normal real estate market, a perfect portrait of a seller’s market. We can expect higher prices in upcoming months, based on these two statistics alone. The only break for slowing down this trend is an increased interest rate, which is destined to rise by the Federal Reserve. If the increased interest rate is not substantial we might witness the continuation of the seller market for rest of the year till either the interest rate or higher home prices become obstacles in obtaining mortgage loans for home buyers.