Port St Lucie Real Estate Market Report June 2015

Home Prices in Port St Lucie

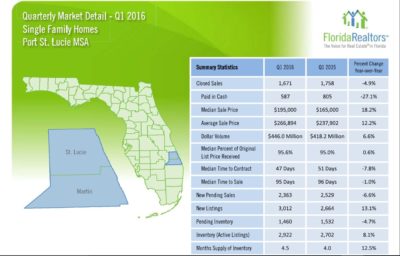

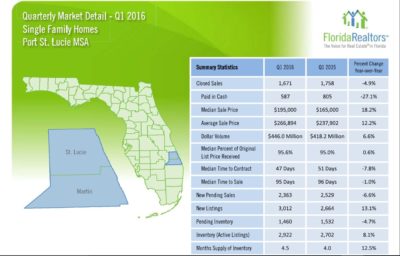

Median prices for homes sold in Port St Lucie Real Estate Market saw an increase of $30,000 in one year alone. Waiting to purchase a home in Port St Lucie area means losing $1000’s and the reports prove that. The Florida Association of Realtors (FAR) has compiled a report on St Lucie County and Port St Lucie real estate market for the first quarter of 2016 in comparison to the same period in 2015. The report is a clear indication of a market with ever-rising prices. The Median Sale Price for Quarter-1 of 2016 is indicated to be at $195,000 a sharp increase of $30,000 from the $165,000 average price of the same quarter in 2015.

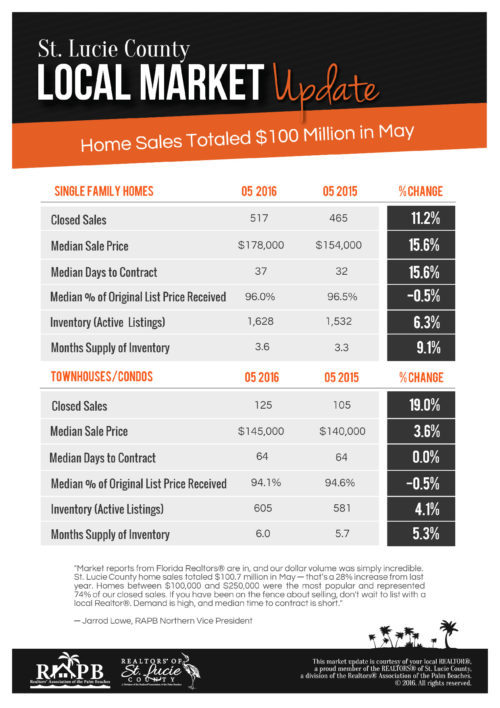

The latest report is the local market update for the month of May 2016 compared to the same month in 2015. This report shows a 15.6% increase for the month of May, with a $24,000 increase in Median Sale Price. The Median Sale Price for May of 2016 was $178,000 up from the $154,000 in 2015.

Although the trend is a clear indication of a seller’s market the low-interest rates have created a unique buyer’s market as well. This combination of events is fueling the price increase and the way we see it, this will continue at least until the beginning of the next year. According to the reports, the Federal Reserve will not touch the current interest rates at least until 2017 and even then it is not clear if there will be an increase. Any changes in the interest rate in 2017 will be the direct result of the drop in the unemployment rate at that time as well as other economic

Port St Lucie Home Sales 1st Quarter 2015

The Port St Lucie home sales market report compiled by the Florida Association of Realtors shows a $30,000 increase in Median Sales Price in Q-1 of 2016 compared to the same period in 2015.

The Port St Lucie home sales market report compiled by the Florida Association of Realtors shows a $30,000 increase in Median Sales Price in Q-1 of 2016 compared to the same period in 2015.

The Median sales price for homes sold in Port St Lucie in 2015 was $165,000 while in 2016 the median is registered at $195,000. Other noteworthy figures in this report were both the Median Time to Contract and Median Time to Sale. The 47 days for Median Time to Contract of sold homes in Port St Lucie indicates a healthy real estate market with homes going under contract well below the 60 days threshold. The Median Time to Sale, on the other hand, portrays a bigger picture.

The 47 days for Median Time to Contract of sold homes in Port St Lucie indicates a healthy real estate market with homes going under contract well below the 60 days threshold. The Median Time to Sell, on the other hand, portrays a bigger picture. The significance of this numbers remains in the anticipated effects of closing time after the enactment of the Consumer Protection Act, or as otherwise known Dodd-Frank Act, in October of 2015. The well-publicized changes had a noticeable effect on the mortgage industry, which created the discussion of prolonged closing periods.

The Q1 Median Time to Sell in 2016 proved otherwise by dropping to 95 days from 96 days in the same quarter the previous year or -1%. the first 47 days from the 95 days were allocated to marketing and only the last 48 days was contributed to the closing process. This is while the cash sales, which reduces the necessary time for closing was down -27% from the first quarter of 2015.

The $30,000, or +18.2% increase in Median Sale Price of homes sold in Port St Lucie in the first quarter of 2016 is another wake-up call for the buyers who are still waiting to purchase a home in Port St Lucie since last year. This is while the buyers who did purchase a home have created equity of $35,940 with a Median Price of $195,000. This trend is here to stay for a while.

In conclusion, the upward trend is here to stay for a while and if remains in the same pace it would reward over $70,000 to the lucky home buyers in Port St Lucie who purchased during the first quarter of 2015 or over $35,000 to the buyers who purchased their homes in the first quarter of 2016. With interest still at historically low rates and great for sale home prices in Port St Lucie, this prediction seems to be on the target.

Please contact us for more information and detailed reports on quarterly sales for a single family home, townhomes and villas in St Lucie, Martin and Palm Beach counties.

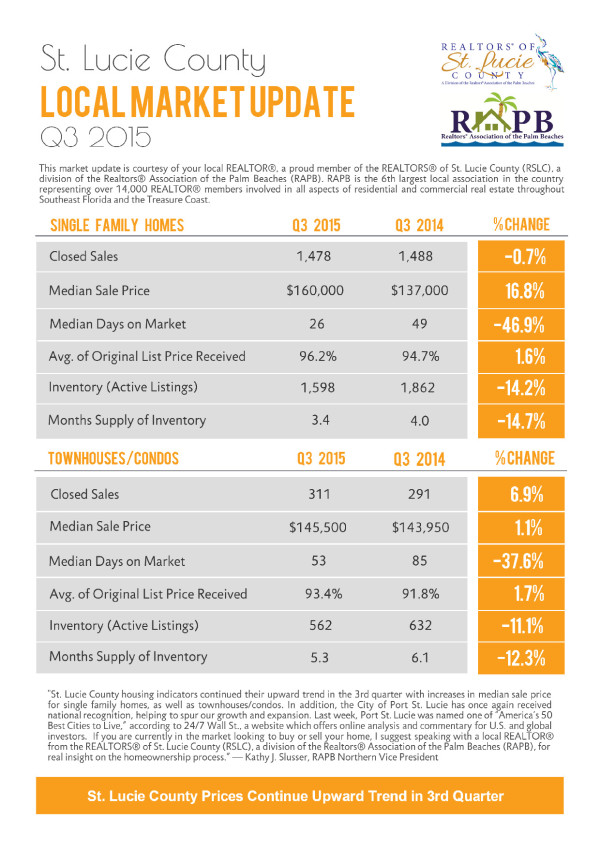

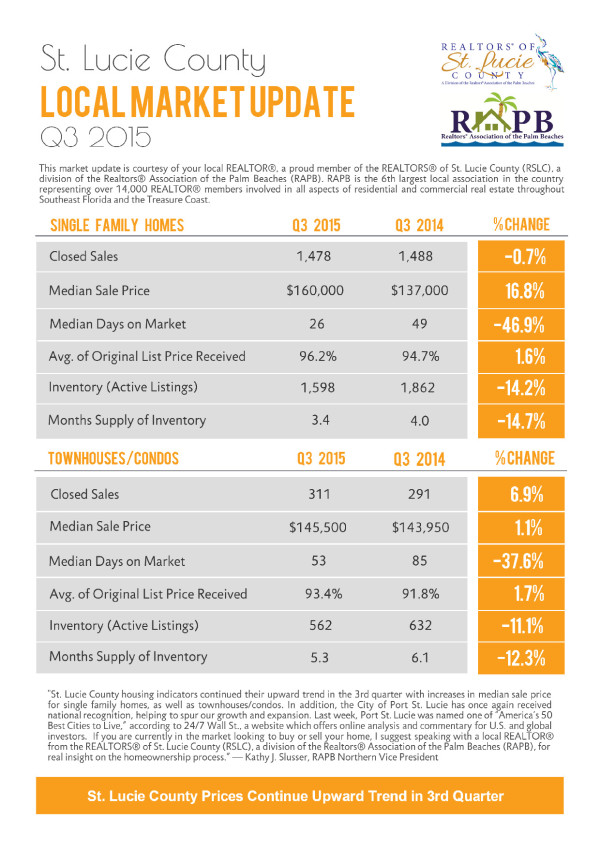

St Lucie County Real Estate Report Q3, 2015

The report on local real estate activities by Realtors® Association of the Palm Beaches (RAPB) shows the continuation of the established trend of rising prices. The most notable changes for single-family homes in the St Lucie County real estate are:

- Median Price- Rose to $167,000 in the 3rd quarter of 2015 from $137,000 in the same period in 2014, a whopping 16.8% increase in one year.

- Average Days on Market- Drop to only 26 days in comparison to 49 days in the 3rd quarter of last year. This is a clear indication of low inventory and high demand, which in turn fuels the rising prices.

- Inventory- Considering the shortage of inventory of homes for sale in 2014, the drop of 14.7% in inventory represents an even bigger problem. With home builders struggling to add to the inventory and continuous shortage of inventory the higher prices are inevitable. The problem for surrounding counties is more severe as some like Palm Beach County has reached the boiling point of maxed out prices much earlier in 2014.

Overall the Port St Lucie real estate report for 2015 indicates a stronger seller’s market which combined with anxious buyers has resulted in listings ending up in the multiple offer situation. This is a reminder of how the market went crazy in the last decade real estate boom. Multiple offers, price war, anxious buyers trying to buy before prices increase even higher while sellers holding back in the hope of cashing out even more in tomorrow’s market. Unless the new home construction catches up with the shortage of inventory, the rise in interest rate seems to be the only unfortunate remedy for slowing down the train before the wreckage arrives as it did only a few years back.

With today’s internet and global data access, most of our home buyers and sellers have a great knowledge about the Port St Lucie real estate market. However, depending on the accuracy of the data, this could be a double edge sword and it is up to the real estate agents to use their knowledge and experience to assist the home sellers and buyers to use updated information and logic. The cardinal rule for negotiating price when buying and selling properties is that everything in real estate is negotiable! Please note that we did not say only the price is negotiable but everything is negotiable. This covers the price as well as many terms and situations affecting the contract process during and after the price negotiation. The following examples will shed more light to what one may encounter during the contract to closing process:

With today’s internet and global data access, most of our home buyers and sellers have a great knowledge about the Port St Lucie real estate market. However, depending on the accuracy of the data, this could be a double edge sword and it is up to the real estate agents to use their knowledge and experience to assist the home sellers and buyers to use updated information and logic. The cardinal rule for negotiating price when buying and selling properties is that everything in real estate is negotiable! Please note that we did not say only the price is negotiable but everything is negotiable. This covers the price as well as many terms and situations affecting the contract process during and after the price negotiation. The following examples will shed more light to what one may encounter during the contract to closing process:

The Port St Lucie home sales market report compiled by the Florida Association of Realtors shows a $30,000 increase in Median Sales Price in Q-1 of 2016 compared to the same period in 2015.

The Port St Lucie home sales market report compiled by the Florida Association of Realtors shows a $30,000 increase in Median Sales Price in Q-1 of 2016 compared to the same period in 2015.

For the past few years there have been many down payment assistance programs available to home buyers through the federal government, state and, local governments housing departments, but somehow it seems that the public has been kept in the dark about the existence of such programs. Right next to credit issues, coming up with the down payment on top of the closing costs have always been one of the main hurdles for home buyers. In most instances the lack of savings has resulted in paying more each month for rent than what the same homeowners would pay for the mortgage if they purchased their own home. To make the matter worse, the lack of the sufficient rental homes in the Port St Lucie market has spiked the prices with renters paying 40% to 50% more on monthly rentals than the people who are purchasing the same type of properties.

For the past few years there have been many down payment assistance programs available to home buyers through the federal government, state and, local governments housing departments, but somehow it seems that the public has been kept in the dark about the existence of such programs. Right next to credit issues, coming up with the down payment on top of the closing costs have always been one of the main hurdles for home buyers. In most instances the lack of savings has resulted in paying more each month for rent than what the same homeowners would pay for the mortgage if they purchased their own home. To make the matter worse, the lack of the sufficient rental homes in the Port St Lucie market has spiked the prices with renters paying 40% to 50% more on monthly rentals than the people who are purchasing the same type of properties.

Placing the right offer price when buying a home in Port St Lucie is the most crucial step in purchasing your dream home. In previous articles, we have emphasized on the methods in assisting you in locating that ideal home as soon as the listing is released to the MLS System. We also discussed the importance of the search tools and “automatic email feature” in MLS that is exclusive to Realtors along with how to stay on top of the market and act quickly. These are all designed to keep you one step ahead of the competition and get your offer in before the competition has even accessed the listing.

Placing the right offer price when buying a home in Port St Lucie is the most crucial step in purchasing your dream home. In previous articles, we have emphasized on the methods in assisting you in locating that ideal home as soon as the listing is released to the MLS System. We also discussed the importance of the search tools and “automatic email feature” in MLS that is exclusive to Realtors along with how to stay on top of the market and act quickly. These are all designed to keep you one step ahead of the competition and get your offer in before the competition has even accessed the listing.